Sea Limited: The Three-Headed Monster

I've been following Sea Limited ADR (NYSE:SE) for quite some time now and the stock got me interested again given the recent 75% selloff. Today, I'm doing a deep dive on the three-headed monster (and each of its heads) to see if the company is a good investment opportunity at these levels. Let's get started!

For those who are interested in learning more about Shopee Indonesia, you can see my previous two articles down below:

Investment Thesis

Sea is at the forefront of the internet revolution in developing regions. This had many investors buying into the growth story of the company, sending shares soaring high into the sun for the better part of 2020 and 2021. However, the stock has cratered back to sea amid concerns about the company's slowing growth, especially for its only cash cow, Garena. To make matters worse, Shopee's losses are also getting worse.

The Group's cash burn rate is still high, estimated to be $(3.6) billion in FY2022. With a net cash position of $5.9 billion, future capital raises are very likely.

On the bright side, Sea still has a long growth runway ahead, solidified by its leadership positions in Southeast Asia and Latin America. SeaMoney, although still unprofitable, could also emerge as Sea's second cash cow.

Despite unprofitability and competitive risks, Sea has strong competitive moats and it is trading at the cheapest valuation multiples since its IPO.

The three-headed monster is a Buy at these levels.

Value Proposition

Founded in Singapore in 2009, Sea has grown to become the leading consumer internet company in the world, with a substantial presence in the Southeast Asian region.

Mission: To better the lives of consumers and small businesses with technology.

Sea is a holding company for three core businesses: Garena, Shopee, and SeaMoney. Sea's main value proposition is providing a vertically-integrated experience through its different core businesses.

Its digital entertainment division, Garena, was Sea's first business venture. In fact, Sea was originally named Garena Interactive Holding Limited before changing its name to Sea Limited in 2017.

Garena is one of the largest online games developers and publishers, releasing some of the most successful mobile and PC games over the last decade. For example, Garena's Free Fire, its self-developed mobile battle royale game, topped the global download charts for the last three years. According to data.ai, Free Fire also ranked second globally by average monthly active users on Google Play in 2021. In Southeast Asia and Latin America, Free Fire was the highest-grossing mobile game for ten consecutive quarters, and in the US for four consecutive quarters. Based on Sensor Tower's findings, Free Fire still holds the most downloads globally as of January 2022.

Garena also exclusively licenses and publishes games from global partners and third-party developers. Some of these partners include Tencent (OTCPK:TCEHY), Activision (ATVI), and Arumgames. Games like Speed Drifters, Arena of Valor, and Fantasy Town fall into this category as they are co-developed with partners or licensed from partners.

In addition, Garena organizes some of the largest e-sports events from local tournaments to professional competitions at a global level. Moreover, Garena offers other entertainment content such as live-streaming, user chat, and online forums.

Perhaps the most exciting business segment is Sea's mobile-centric e-commerce platform, Shopee. Launched in 2015, Shopee is now one of the fastest-growing e-commerce marketplaces with a strong presence in Southeast Asia, as well as growing recognition in Latin America and some European countries.

Through the Shopee platform, buyers can purchase items from sellers which are primarily small and medium businesses (or mom-and-pop stores). At the same time, larger, more established retailers like Xiaomi (OTCPK:XIACF), Microsoft (MSFT), or Samsung (OTC:SSNLF) can leverage Shopee's two premium shopping platforms, Shopee Mall and Shopee Premium.

Along with Shopee's e-commerce marketplace, Shopee also offers adjacent products and services for both buyers and sellers:

Shopee's scale is unmatched and it is still growing at an unprecedented pace. According to data.ai, Shopee in Southeast Asia and Taiwan ranked first in average monthly active users and total time spent in the app in 2021. Shopee Indonesia, arguably Shopee's most important market, ranked first in the Shopping category. Shopee Brazil, which launched in October 2019, was also ranked first in the Shopping category. And globally, Shopee ranked first in the Shopping category, and is the #13 most downloaded app regardless of category, logging in 200+ million downloads in 2021.

SeaMoney was launched in 2014 and is now one of the leading digital financial services providers in Sea's operating countries. SeaMoney offers mobile wallet services, payment processing, credit, and other digital financial services. These services are offered under SeaMoney's various brands including AirPay, ShopeePay, SPayLater, and other local brands depending on the country. SeaMoney was initially launched in Vietnam and Thailand but has since expanded to other regions.

Through SeaMoney's mobile wallet offerings, consumers and merchants have added flexibility in terms of payment options, whether through online or offline means. The launch of SPayLater, which is basically a "buy now pay later" payment option, enables consumers to purchase items without accessing credit. For those who are interested, I've written a deep dive on Affirm (AFRM) where I discuss the main value propositions that BNPL provides.

SeaMoney has obtained bank licenses and government approvals to provide financial services in various countries. For example, Sea acquired Bank Kesejahteraan Ekonomi in Indonesia back in early 2021 as a push towards offering a digital banking solution. The company is now rebranded to SeaBank, which currently offers a high-yield savings account and virtual account.

SeaMoney's main value proposition lies in offering a mobile wallet and payment solutions that are integrated with Sea's other businesses, namely Garena and Shopee, enabling consumers and merchants to transact seamlessly in one vertically-integrated platform.

Market Opportunity

Sea's market opportunity is predicated around the industry outlook of each of its business segments: mobile gaming, e-commerce, and fintech. Let's take a look at each industry that Sea operates in.

First, we have the mobile gaming industry. According to data.ai, Mobile Game Consumer Spend grew from $74 billion in 2018 to $116 billion in 2021, while Mobile Game Downloads grew from 63 billion in 2018 to 83 billion in 2021. Among the Top Genres by Downloads were Hypercasual games such as Hair Challenge and Water Sort Puzzle. However, the Top Genres by Consumer Spend belong to the Strategy, RPG, and Shooting categories where Garena specializes in. For example, Free Fire was the top Shooting game by revenue in Thailand, Brazil, Mexico, and the US, in 2021. Globally, however, it is still behind PUBG Mobile, which generates the bulk of its revenue from China.

According to Adjust, the mobile gaming industry is expected to reach $272 billion by 2030, which is about 1.5x of 2021's total figure. Given Garena's successes in monetizing its games, Garena should continue to enjoy gaming tailwinds in the foreseeable future, provided that its games remain in trend. This is also supported by Unity's findings that the APAC region is the fastest-growing regional market, a market that Garena dominates in.

Moving on to e-commerce, we all know that e-commerce is growing rapidly and that its market share as a whole will continue to trend up from here. This is especially true for the Southeast Asian region where internet and smartphone adoption continues to increase by the day. Based on the e-Conomy SEA report, Southeast Asia now has 440 million internet users, up from 360 million in 2019. Its total population is about 589 million.

Internet Gross Merchandise Value, or GMV, for the region was $170 billion in 2021 and is expected to reach $360 billion by 2025 with e-commerce leading the charge. The shift to e-commerce is not only happening on the consumer side but also on the merchant side. Digital marketing tools, analytical tools, and digital payment solutions have accelerated business for merchants. Shopee's vertically-integrated platform also makes it easy for merchants in these developing countries to set up shop, distribute goods, and accept payments in a single platform.

Furthermore, Sea has recently expanded its e-commerce operations to other regions such as Latin America and Europe, which further expands its market opportunity.

Lastly, we have the fintech industry pertaining to SeaMoney. In my PayPal (PYPL) deep dive, I discussed the growth of mobile wallets as a payment method in both online and offline transactions. The shift to a cashless and cardless society is inevitable and that is also true for Sea's markets.

As you can see below, mobile wallets continue to gain traction in Southeast Asia. In addition, 92% of digital merchants intend to maintain usage or increase usage of digital payments in the next 1 to 2 years. ShopeePay and SeaMoney's other brands will benefit from this trend. Also of important note, SeaMoney's expansion to buy now pay later with SPayLater will be a key GMV and revenue driver for the segment. These are the reasons why some investors are so bullish on SeaMoney and why SeaMoney is a monster lurking in the shadows.

As you can see, Sea is at the forefront of three megatrends which should propel the business forward from here. Also, combining the different verticals in the same platform would present a significant synergistic opportunity as Sea establishes itself as a SuperApp in the making.

Revenue Model

As mentioned previously, Sea operates three main business segments.

Garena operates a freemium model whereby users can download and play games for free. The company generates revenue by selling in-game virtual items such as clothing, weaponry, or equipment.

Investors should take note of how revenue is recognized for this segment. According to Sea's 10-K:

Proceeds from these sales are initially recognized as “Advances from customers” and subsequently reclassified to “Deferred revenue” when the users make in-game purchases of the virtual currencies or virtual items within the games operated by the Company and the in-game purchases are no longer refundable.

Garena also licenses games from other game developers. Revenue is generated based on revenue-sharing/royalty agreements with these developers. Revenue is recognized over the performance obligation period.

Such delivery obligation period is determined in accordance with the estimated average lifespan of the virtual goods sold or estimated average lifespan of the paying users of the said games or similar games.

Shopee generates revenue through a marketplace model. Sellers on the platform pay Shopee based on paid advertisement services, transaction-based fees, logistics services, and other value-added services.

Shopee also generates revenue from goods sold directly by Shopee, which the company purchases in bulk from manufacturers or third-party suppliers.

SeaMoney revenue consists of:

Income Statement

Let's analyze each of the business segments and then look at the entire Group as a whole.

Garena Revenue saw a 104% increase YoY in Q4. For the full year, Garena Revenue was up 114% YoY.

—

The drop in Bookings was due to fewer gamers in the platform as the economy reopens and people spend more time outdoors, at school, or in the office. Quarterly Active Users, or QAUs, grew only 7% in Q4 to 652 million, compared to Q3's QAUs of 729 million.

As a result, Quarterly Paying Users, or QPUs, decelerated as well, which led to lower Bookings. Q4 QPUs was 77 million compared to Q3's 93 million.

The markets reacted negatively to this slowdown in Garena growth as the gaming business acts as the lifeline for Sea's two other segments. As you can see, Garena is a high-margin business, producing Adjusted EBITDA of $2.7 billion in FY2021. Operating Margin is very high at 61% in Q4. AEBITDA margin, on the other hand, is trending downwards as QoQ adds in Bookings wither.

As such, the slowdown in growth for Garena is scaring investors away as it may not provide sufficient cash flow to fund the continued growth of Shopee and SeaMoney.

Shopee GMV continues its upward march as e-commerce continues to gain traction in Shopee's existing and newer markets. However, we're also seeing a deceleration in growth due to tough YoY comps. GMV in FY2021 was $62.5 billion, an increase of 77%.

GMV growth was also due to an increase in Orders in the Shopee platform, which totaled 6.1 billion in FY2021, an increase of 117%. Average Order Value, or AOV, however, is trending downwards. This may be perceived negatively as processing more lower-AOV orders meant higher logistical expenses and thus lower margins per order.

The increase in GMV translated to higher Shopee Revenue, which grew faster than GMV. Shopee Revenue grew 136% to $5.1 billion in FY2021, as compared to GMV growth of 77%.

The faster growth in Revenue was due to Shopee's increasing take rate, which displays Shopee's ability to monetize its marketplace platform. This is one of the only few positive developments coming out of the most recent earnings update.

Despite the improving Revenue and take rate, Shopee is still suffering huge losses and it is mounting with each subsequent quarter, primarily due to the company expanding into new markets. FY2021 Shopee AEBITDA was $(2.6) billion at a -50% margin. Recall that Garena AEBITDA was $2.7 billion.

AEBITDA per Order has been improving, although it flat-lined in the last few quarters. Again, this is due to the company aggressively expanding into new markets. For example, in Q4, Shopee Brazil recorded 140+ million gross orders with a $70+ million Revenue, up 400% and 326%, respectively. However, AEBITDA per Order in Brazil is still negative at $(2) per Order, despite being a 40% improvement from last year. As such, it is still a far cry from the overall AEBITDA per Order of $(0.45).

On the bright side, in Southeast Asia and Taiwan, Q4 AEBITDA per Order before "allocation of the headquarters’ common expenses" was $(0.15), an improvement from last year's $(0.21). This shows that there is certainly hope for Shopee to be AEBITDA positive soon, which management has pointed out during the Q4 earnings call:

We currently expect Shopee to achieve positive adjusted EBITDA before HQ cost allocation in Southeast Asia and Taiwan by this year. We also expect SeaMoney to achieve positive cash flow by next year. As a result, we currently expect that by 2025 cash generated by Shopee and SeaMoney proactively will enable these two businesses to substantially self-fund their own long-term growth.

SeaMoney's Mobile Wallet Total Payment Volume grew 120% YoY to $17.2 billion in FY2021 due to the increasing adoption of mobile wallets in the region.

The growth in TPV was largely driven by the growth in QAUs. As shown below, the total ending QAUs in Q4 grew 90% YoY to 45.8 million users.

The real exciting part is that Revenue grew much faster than TPV and QAUs. SeaMoney Revenue is growing at a blistering pace, locking in high triple-digit growth rates over the last few years. FY2021 SeaMoney Revenue was $470 million, which is an increase of 673% from the previous year. This is due to take rates increasing from less than 1% in FY2020 to almost 4% by the end of the latest quarter.

Furthermore, in Indonesia, over 20% of the QAUs have used more than one SeaMoney product or service, which includes credit services, digital banking, and insurance. As SeaMoney introduces more offerings, revenue should accelerate meaningfully as average revenue per user increases when people use additional products.

As SeaMoney continues to gain scale, the segment will enjoy better unit economics. As shown below, while SeaMoney's AEBITDA is still in deeply negative territories, AEBITDA Margins has continued to trend towards profitability. Management also expects SeaMoney to be cash flow positive by next year.

This is the segment that investors should pay special attention to, given that it has the potential to be Sea's second cash cow. For example, PayPal has Operating Margins of 20%+, which could be SeaMoney's long-term margin profile.

With that said, let's take a look at how the business is doing as a whole.

FY2021 Revenue was $10.0 billion, an increase of 128% YoY. Due to the law of large numbers and tough YoY comps, Revenue growth should decelerate from here.

Here, we can see how Revenue is distributed across the different segments.

What's encouraging is that Gross Profit Margins continue to trend upwards as the company gains economies of scale, even accounting for Shopee's aggressive expansion into new markets. FY2021 Gross Profit was $3.9 billion, up 189% YoY.

Operating Expenses, however, remain elevated as management forgoes short-term profitability for long-term market dominance. FY2021 Total Operating Expenses were $5.5 billion. Below shows the different components of Operating Expenses as a percentage of Revenue.

Most of the Operating Expenses were used for Sales & Marketing purposes. Unsurprisingly, Shopee had the highest S&M burn rate. Discounts, cashback, celebrity promotions... they're everywhere.

As a result, Operating Profit Margins is still negative, although it is trending in the right direction.

AEBITDA, on the other hand, is plunging. This is due to Garena's falling Bookings and Shoppe's widening losses. AEBITDA for FY2021 was $(594) million, compared to FY2020 positive AEBITDA of $107 million. This is probably the most concerning figure for investors as such a high cash burn rate is unsustainable, which may also lead to additional capital raises that are dilutive to shareholders.

The guidance did not help either. Garena Bookings is expected to fall to just $3 billion, which is $1.3 billion lower than FY2021's number. Management blamed the reopening of the economy as well as the ban of Free Fire in India for the expected drop in Bookings. Assuming a modest 50% AEBITDA margin, Garena would bring in just $1.5 billion of AEBITDA for Sea in FY2022.

On the other side, the other two segments are expected to continue with their immense pace of growth — Shopee and SeaMoney are expected to grow by 76% and 155%, respectively. If we assume a (50)% AEBITDA margin for both segments, Shopee and SeaMoney is expected to burn a total of about $(5.1) billion of AEBITDA. Adding Garena's estimated AEBITDA of $1.5 billion, Sea, as a Group, is expected to burn $(3.6) billion in FY2021.

Because Garena is such an important piece of Shopee's and SeaMoney's growth story, a deceleration in Garena's business had investors reacting so negatively to Sea's latest earnings release, as now, the gaming business is incapable of covering the massive losses incurred by the other two business segments.

Balance Sheet

Sea's balance sheet position as of year-end FY2021 is at about $10.2 billion of Cash and Short Term Investments. While this may show that Sea has a substantial cushion against its short-term cash burn rate, its net cash position paints a different picture.

Adjusting for Sea's debt, Sea ended the year with a net cash position of around $5.9 billion. A substantial amount of its total debt comes from its recent issuance of 0.25% Convertible Senior Notes due 2026. The notes were issued when the stock was trading at $318 per share back in September and the initial conversion price is set at $477 per share. So, yes... conversion in the next 2 to 3 years is very unlikely.

With net cash of $5.9 billion and $(3.6) billion of estimated AEBITDA in FY2022, it won't be long before Sea requires another cash infusion. Therefore, if the high cash burn rate persists for the next 2 to 3 years, investors face a major risk of increasing financial leverage and/or dilution in the form of equity raises.

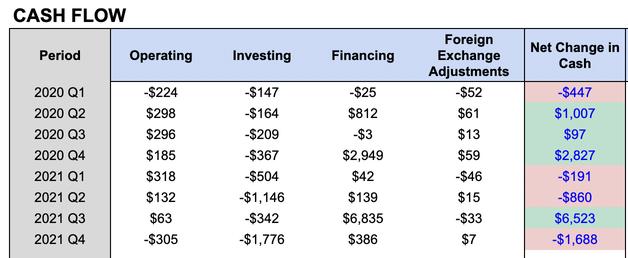

Cash Flow Statement

Here is what cash flow looks like over the last few quarters. Notice how Operating Cash Flow turned negative in the last quarter. Most of the cash also comes from Financing activities.

Unlike other high-flying growth companies, Sea's Share-Based Compensation expenses are relatively low.

Competitive Moats

Based on my research and analysis, I identified three key competitive moats for Sea: brand, network effects, and barriers to entry. I used to think that Sea has cost advantages but as Garena becomes a smaller part of the overall business, and as losses continue to worsen, I have reason to believe that Sea no longer holds that moat.

As discussed in previous sections, Garena's games, particularly Free Fire, have consistently ranked as the most downloaded mobile game in the world. Additionally, the Shopee app has gained cross-border stardom and is now regarded as the most downloaded or fastest-trending shopping App in the countries it operates in. Lastly, SeaMoney is also gaining traction with banking licenses granted in various countries that should increase brand value and trust.

The sheer amount of app downloads leads to powerful network effects. Garena has 652 million QAUs, which is about 8% of the world's population. Shopee recorded 200+ million app downloads in FY2021 alone. SeaMoney QAUs topped 45.8 million in Q4 and it is still in the early stages of adoption.

With all these users in the Sea platform, cross-selling new products or services should be easier as Sea continues to scale. One such example is Shopee Brazil and Free Fire where each platform is encouraging consumers to use the other. As Sea continues to innovate and offer better experiences for its customers, the ecosystem gets bigger and tighter, leading to powerful network effects.

I believe each of Sea's core businesses is operating in a winner-takes-most environment with high barriers to entry.

The mobile gaming environment requires the most talented developers to launch blockbuster games. Garena's Free Fire is certainly a blockbuster game and time in Free Fire's game means time away from other mobile games.

Just like how Amazon (AMZN) dominates in the US, the e-commerce landscape in Southeast Asia and Latin America is dominated by a few players, such as Shopee, Tokopedia, and MercadoLibre (MELI). The scale and unit economics that these players have achieved makes it unsustainable for new entrants to compete with them.

Banking and fintech is also a highly-regulated environment. Furthermore, consumers prefer to have just one mobile wallet, such as ShopeePay, as opposed to owning several different fintech applications.

Valuation

Based on my sum-of-the-parts and comparable company valuation analysis, Sea looks to be slightly undervalued with 19% upside potential. Of course, comparables are not perfect but based on this, we can gauge where Sea stands among peers.

On the flip side, Sea looks extremely cheap on a historical basis. In terms of EV/Sales, Sea is trading at the lowest valuation since its IPO, trading at just 4.2x forward sales.

In terms of EV/Gross Profit, Sea is trading even cheaper than its March 2020 lows.

The valuation compression is warranted given that the company flew too close to the sun and now it is cratering back to the sea — not just for Sea, but almost all growth stocks took a beating. Growth is also slowing down and the macroeconomic environment looks gloomier than ever. However, this is not the end of the world; I think the markets are overreacting. Diversion from the mean goes both ways — perhaps, current prices present a good margin of safety for long-term investors.

Catalysts

We will continue to encourage user-generated content by enhancing greater features and accessibility. We believe that a strong user reception to Craftland is a positive indicator of the initial success to encourage user participation in content creation and to build Free Fire into an increasingly open platform and is well aligned with major emerging industry trends such as metaverse.

Risks

In addition, there's a certain level of pride for consumers to see their native-born companies succeed. I'm Indonesian, and it makes me really happy to see GoTo grow and grow.

GoTo, the holding company of both Indonesian tech darlings Gojek and Tokopedia, recently announced its plan to IPO in the Indonesia Stock Exchange. Here's a glance of GoTo's stats for the 12-months ended 30 September 2021:

The point is that there are big-time local players operating in Sea's markets that investors should never ignore. Here's a little snippet from my previous Shopee article:

But with the GoTo merger, Indonesia could potentially extinguish the orange flame that charred its forest for many years. Now, GoTo could finally reclaim a good chunk of its territory that was lost to waves of competition, especially from Shopee. GoTo could finally gain more ground as the roots grew even stronger with the merger, fertilized with the synergies of value propositions, logistics, payments, and banking solutions.

Meanwhile, Sea Limited's stock continues to soar, ignoring the titan of an elephant in the room. And because of GoTo's integration, Shopee's vertically-integrated business model doesn't look like a strong competitive advantage anymore.

Conclusion

Each of Sea's core businesses is in hypergrowth mode, propelled by megatrends in the mobile gaming, e-commerce, and fintech industry. Management understands these opportunities and therefore, is sacrificing short-term profitability for long-term market dominance. Despite being a larger business, Sea still has a massive growth runway ahead.

That is not to say that unprofitability and competition risks can and should be ignored. The biggest concern for investors is the company's unsustainable cash burn rate, which will likely lead to further capital raises in the near future.

Nonetheless, the long-term growth thesis for the three-headed monster remains intact. Strong brand, network effects, and barriers to entry moats should support the business going forward. In addition, shares of Sea are trading at the lowest valuation multiples ever, which presents a good margin of safety for an entry at these prices.

Thank you for reading my Sea Limited deep dive. If you enjoyed the article, please let me know in the comment section down below. If you have any suggestions or feedback, don't hesitate to share your thoughts as well.

}})